|

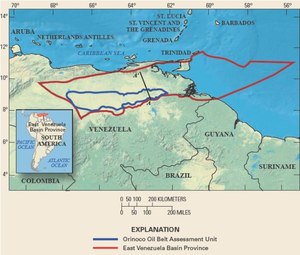

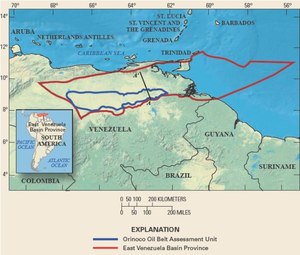

| Fig. 1: Map of the Orinoco Basin (Source: Wikimedia Commons) |

Venezuela is endowed with significant natural resources, particularly with regards to its oil reserves. As a founding member of OPEC, Venezuela has played a large role in global oil markets for the past century. However, recent economic and political turmoil, declining oil markets, and the effect of U.S sanctions in response to election fraud of current president Nicolas Maduro has made Venezuela's once successful, oil-rich economy grind to a halt in terms of production.

Venezuela's oil industry is nationalized. The state oil company PDVSA (Petrleos de Venezuela) is one of the largest in the world. Venezuela has the largest proven reserves of oil in the world, with 303.8 billion barrels. [1] This makes up 17.5% of the world's global reserves. Over 77% of these reserves is found in the Orinoco Belt, which is located in the eastern portion of Venezuela. [1] Another source of reserves is in the Maracaibo Basin, located in Lake Maracaibo. This is estimated to hold a total of 52 billion barrels of both produced and potential oil. This oil is relatively light. [2] Much of the crude oil found in the Orinoco Belt is quite heavy, which makes it particularly difficult to refine. The second largest oil reserves are found in Saudi Arabia, which comparatively has much lighter oil making it easier to refine. [1] Furthermore, the carbon emissions from producing heavy oil are higher, and Venezuela is one of the most carbon-intensive oil producers. [3]

Venezuela's production is also reaching record lows. In 2020, Venezuela's production per day was 540 thousand barrels. This was a decline from 2019 of 41.2%. [1] This year, Venezuela is expected to net $2.3 billion, a large decline from a decade ago when the country netted $90 billion. [4] In order to increase production and exports, PDVSA estimates it would require $58 billion dollars of external investment to increase production to its 1998 level of 3.4 million barrels per day. [5] The opposition in Venezuela estimates an even higher number, and suggests that it might require as much as $78 billion over the next 10 years to return production to 3.1 million barrels per day. [5]

Since Venezuela's extra-heavy crude oil is particularly difficult to refine, the state of the countrys oil producing capability makes recovery difficult. Part of the problem is Venezuela's infrastructure, which has been deteriorating as a result of underinvestment and mismanagement. PDVSA's Petrocedeo operation processed the extra heavy crude oil into lighter oil, but external investors TotalEnergies and Equinor exited their investment in the operation at a loss. [6] Furthermore, PDVSA lacks the skilled workforce to properly maintain its infrastructure. In 2003, President Hugo Chavez fired 18,000 workers from PDVSA who went on strike. More recently, in 2017 alone an estimated 25,000 employees resigned, with many of them skilled workers. [7] Many senior officials have been replaced with military officers. Venezuela requires significant external investment to maintain and upgrade its infrastructure, but U.S. Sanctions and Venezuela's significant debt have made it unattractive to investors. However, since 2008 China has lent Venezuela around $60 billion for oil projects, with some of it being repaid in crude oil shipments. [8] PDVSA's connection with China has since continued, with direct oil shipments from Venezuela to China reported.

The U.S first placed sanctions on Venezuela in 2017 in response to the election that saw Nicolas Maduro retain power. The U.S officially recognizes the President of the National Assembly, Juan Guaido, leader of the opposition. Since the implementation of those sanctions, estimates are that Venezuela has lost between $17-31 billion in revenue from oil production. [9] PDVSA's majority-owned US-based operation is no longer economically viable either due to the sanctions. US oil companies are barred from drilling in the country. [4] Unless sanctions are lifted, finding the external investment needed will be difficult.

The combination of Venezuela's economic instability, sanctions, and mismanaged oil industry have halted the output of the industry. The influence of external investment from multinational oil companies may decide the future of the Venezuelan oil industry. Changes in the regime may lift US sanctions in the future and bring about a recovery, albeit difficult. With such rich natural resources, recovery of Venezuela to its previous levels may bring economic stability to the country.

© Alexander Lerner. The author warrants that the work is the author's own and that Stanford University provided no input other than typesetting and referencing guidelines. The author grants permission to copy, distribute and display this work in unaltered form, with attribution to the author, for noncommercial purposes only. All other rights, including commercial rights, are reserved to the author.

[1] "BP Statistical Review of World Energy 2021," British Petroleum, June 2021.

[2] J. Guzman and W. Fisher, "Early and Middle Miocene Depositional History of the Maracaibo Basin, Western Venezuela," The Am. Assoc. Pet. Geol. Bull. 90, 625 (2006).

[3] M. S. Masnadi et al.," Global Carbon Intensity of Crude Oil Production," Science 361, 851 (2018).

[4] S. Urdaneta, A. Kurmanaev, and I. Herrera, "Venezuela, Once an Oil Giant, Reaches the End of an Era," New York Times, 26 Nov 20.

[5] L. Cohen, "(Official) Venezuela Needs $58 Bln to Restore Crude Output to 1998 Levels - Document," Reuters, 10 May 20.

[6] "Total, Equinor Exit Venezuela Oil Venture, Citing Carbon Intensity," Reuters, 29 Jul 21.

[7] D. Buitrago and A. Ulmer, "Under Military Rule, Venezuela Oil Workers Quit in a Stampede," Reuters, 16 Apr 18.

[8] F. Zerpa, "China's Top Oil Producer Prepares to Revive Venezuela Operations," Bloomberg, 1 Sep 21.

[9] L. Oliveros, "Impacto de las Sanciones Financieras y Petroleras Sobre la Economia Venezolana," WOLA, October 2020.