|

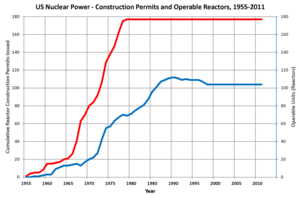

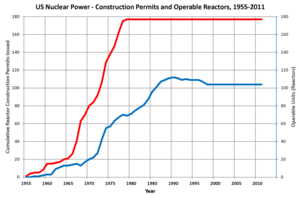

| Fig. 1: US reactor construction permits issued and operating nuclear power reactors, 1955-2011. [8] (Source: Wikimedia Commons ) |

While the debate surrounding energy policy is increasingly centered around clean energy and alternative energy sources, the intersection between policy and action often boils down to a single common factor - cost. The question of nuclear energy as a viable energy source is therefore a matter of profitability and its life-time costs. Typically, nuclear power plants have high capital cost for building the first several plants. [1] After which, economies of scale and the development of supply chains drive the costs of each additional plant down. During its operation, fuel, operational, and maintenance costs are relatively small components of the total cost and the long service life and relatively high productivity of nuclear power plants allow sufficient funds for its planned decommissions and waste management. Within the United States, while there are currently nuclear reactors under construction and planned, no new nuclear reactors have gone online since 1996 (Fig 1). However, since 2000, while no new construction permits have been issued, the United States Nuclear Regulatory Commission has issued renewal licenses for 71 reactors and is considering 19 more. [2]

Capital cost - the cost of constructing and engineering the plant - represents a large percentage of the cost of nuclear energy. The US Energy Information Administration estimated that for new nuclear plants to go into service in 2019, capital costs will make up 74% of the cost of electricity; higher than the capital percentages for fossil-fuel power plants - 63% for coal and 22% for natural gas, but lower than the capital percentages for other renewable sources - 80% for wind and 88% for solar PV. [3] The OECD Nuclear energy agency estimates that the overnight capital cost of constructing of a nuclear power plant - excluding financing, escalation and inflation- at $3,850 kWe. This is considerably lower than the cost of constructing a nuclear power plant in the U.S. - which is estimated to be $5,339/kW. [4] The IEA-NEA Nuclear Energy Roadmap estimates that the U.S. overnight capital cost is similar to that of the EU at $5,500/kW but is still 30% higher than China at approximately $3,500/kW and 25% above South Korea and India. [5]

Generally, coal and nuclear plants have similar operational cost compositions - operational and maintenance costs plus fuel costs. However, nuclear plants have lower fuel costs and higher operating and maintenance costs. The main operating cost of nuclear power plants comes to the cost of its fuel: uranium. Fuel costs account for approximately 28% of a nuclear plant's operating expenses. [6] And while uranium itself is not incredibly expensive, it has to be enriched and fabricated before it can be used in a nuclear power plant. Thus, as of 2013, half the cost of reactor fuel was taken up by enrichment and fabrication, amounting to 14% of operating costs. [7]. However even then, nuclear power plants have lower fuel costs than other types of plants: in the US in 2014, fuel costs for nuclear power plants were $.0077/kWh and only 21% of the variable cost of production, compared to $.0294/kWh for fossil steam plants (75% of variable costs) and $.0371/kWh for gas turbine (87%). [1]

Different types of energy plants can be compared via a levelized cost of electricity (LCOE) - the price that the electricity must fetch if the project is to break even (after taking account of all lifetime costs, inflation and the opportunity cost of capital through the application of a discount rate). The LCOE of nuclear energy plants coming online in 2020 was $95.2/MWh, comparable to conventional coal ($95.1/MWh), above conventional combined cycle natural gas-fired plants ($75.2/MWh) but below conventional combustion turbine natural gas-fired plants ($141.5/MWh). [6]

© Kalvin Wang. The author warrants that the work is the author's own and that Stanford University provided no input other than typesetting and referencing guidelines. The author grants permission to copy, distribute and display this work in unaltered form, with attribution to the author, for noncommercial purposes only. All other rights, including commercial rights, are reserved to the author.

[1] M. Kazimiet et al., "The Future of the Nuclear Fuel Cycle Massachusetts Institute of Technology, 2011.

[2] "Reactor License Renewal ," U.S. Nuclear Regulatory Commission, June 2012.

[3] "Annual Energy Outlook 2018," U.S Energy Information Administration, February 2018.

[4] "Updated Capital Cost Estimates for Electricity Generation Plants," U.S. Energy Information Administration, November 2010.

[5] "Nuclear Energy: Technology Roadmap," Nuclear Energy Agency, 2015

[6] Z. Long, "Economics of Nuclear Power as an Energy Source," Physics 241, Stanford University, Winter 2016.

[7] S. Hargreaves, "What's Behind the Red-Hot Uranium Boom," CNN Money, 19 Apr 07.

[8] "Annual Energy Review 2011," U.S. Energy Information Administration DOE/EIA-0384(2011), September 2012.